Connect with us for all your queries

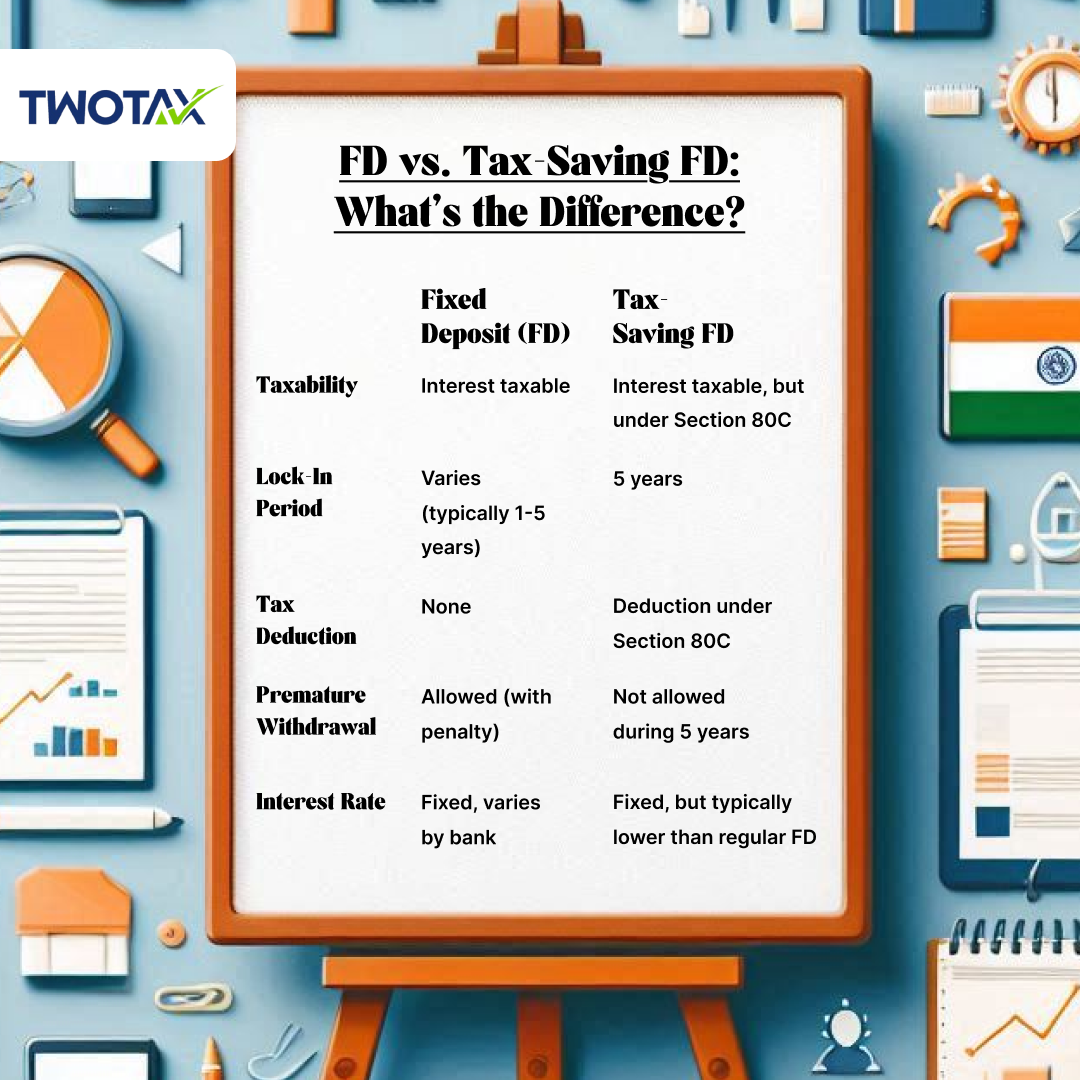

Fixed deposits are one of the most popular investment options in India, offering a safe and secure way to grow savings. They provide guaranteed returns over a specified tenure, making them an attractive choice for conservative investors. In India, there are two main types of fixed deposits: regular fixed deposits and tax-saving fixed deposits. While both serve the primary purpose of wealth accumulation, they differ significantly in terms of features, tax implications, and withdrawal conditions.

A regular fixed deposit is a financial instrument offered by banks and financial institutions where an individual can deposit a lump sum amount for a predetermined period at a fixed interest rate. The key characteristics include:

Tenure: Typically ranges from 7 days to 10 years.

Interest Rates: Generally higher than savings accounts but can vary based on the bank and market conditions.

Liquidity: Funds can be withdrawn before maturity, although penalties may apply.

A tax-saving fixed deposit, on the other hand, is specifically designed to provide tax benefits under Section 80C of the Income Tax Act, 1961. It encourages individuals to save while also availing tax deductions. Key features include:

Lock-in Period: A mandatory lock-in period of 5 years, during which funds cannot be withdrawn.

Tax Deduction: Investments up to ₹1.5 lakh per financial year qualify for tax deductions under Section 80C.

Interest Rates: Similar to regular FDs but may vary slightly based on bank policies.

.png)

Tenure

The tenure for regular FDs can be tailored according to individual needs, allowing flexibility for short-term or long-term investments. For instance, if someone wants to park their money for just six months while waiting for a better investment opportunity, they can easily do so with a regular FD.

In contrast, tax-saving FDs have a stringent lock-in period of five years. This feature is beneficial for those looking to cultivate disciplined savings habits but may not suit individuals who require liquidity in their investments.

Tax Benefits

One of the most significant advantages of tax-saving FDs is the ability to claim deductions under Section 80C. This provision allows individuals to reduce their taxable income by investing up to ₹1.5 lakh in these FDs each financial year. For example, if an individual earns ₹10 lakh annually and invests ₹1 lakh in a tax-saving FD, their taxable income reduces to ₹9 lakh.

Regular FDs do not offer such benefits; the interest earned is added to the individual's total income and taxed according to their applicable income tax slab. If the interest earned exceeds ₹40,000 in a financial year (₹50,000 for senior citizens), TDS is deducted at source.

Interest Rates

Both types of FDs generally offer competitive interest rates compared to traditional savings accounts. However, banks may offer slightly higher rates for regular FDs due to their flexible nature and lack of restrictions on withdrawals.

For example, if Bank A offers an interest rate of 6% on regular FDs and Bank B offers 5.75% on tax-saving FDs, investors might prefer Bank A unless they are specifically looking for tax benefits.

Withdrawal Conditions

The ability to withdraw funds from regular FDs provides investors with liquidity when needed. For instance, if an emergency arises requiring immediate funds, an investor can withdraw from their regular FD after paying any applicable penalties.

In contrast, tax-saving FDs do not allow withdrawals before maturity except under specific circumstances such as the death of the account holder. This restriction ensures that investors remain committed to their long-term financial goals but may pose challenges in emergencies.

To illustrate the differences between regular and tax-saving fixed deposits more vividly, consider the following scenarios:

Scenario 1: Regular Fixed Deposit

Ravi has ₹2 lakhs that he wishes to invest in a regular FD for one year at an interest rate of 6%. At maturity, he will receive:

Maturity Amount=Principal+Interest=2,00,000+(2,00,000×0.06)=2,12,000

Maturity Amount=Principal+Interest=2,00,000+(2,00,000×0.06)=2,12,000

If Ravi's total interest earned exceeds ₹40,000 in his total income for the year (including this FD), he will be subject to TDS on that amount.

Scenario 2: Tax-Saving Fixed Deposit

Anita decides to invest ₹1 lakh in a tax-saving FD for five years at an interest rate of 5.75%. She can claim this amount as a deduction under Section 80C in her income tax return:

Maturity Amount=Principal+Interest=1,00,000+(1,00,000×0.0575×5)=1,28,750

Maturity Amount=Principal+Interest=1,00,000+(1,00,000×0.0575×5)=1,28,750

While Anita benefits from the tax deduction now, she will need to pay taxes on the interest earned during each financial year as per her income slab.

In summary, both regular fixed deposits and tax-saving fixed deposits serve essential roles in personal finance management within India’s investment landscape. Regular FDs provide flexibility and liquidity ideal for short-term goals or emergencies while offering competitive interest rates.

On the other hand, tax-saving FDs encourage long-term savings with attractive tax benefits but come with restrictions on withdrawals that promote disciplined investing over five years.

When choosing between these two options, investors should carefully assess their financial goals, liquidity needs, and tax situations. By understanding these differences thoroughly and utilizing practical examples as guidance, individuals can make informed decisions that align with their investment strategies and overall financial health. This outline serves as a foundation for expanding into a full article by adding more examples, case studies on how individuals have benefited from each type of FD over time or incorporating expert opinions on investment strategies related to fixed deposits. Each section can be enriched with data points or personal anecdotes from investors reflecting their experiences with both types of deposits in real-life scenarios.

Tax Partner is India’s most reliable online business service platform, dedicated to helping you in starting, growing, & flourishing your business with our wide array of expert services at a very affordable cost.