Understanding India's Tax Landscape: Choosing Between the Old and New Tax Regimes

The Indian tax landscape underwent significant reform with the introduction of the new tax regime in Budget 2020, offering lower tax rates but eliminating several longstanding exemptions and deductions. As taxpayers gear up for the FY 2024-2025, the choice between the old and new tax regimes has sparked considerable debate and scrutiny.

Understanding the New Tax Regime

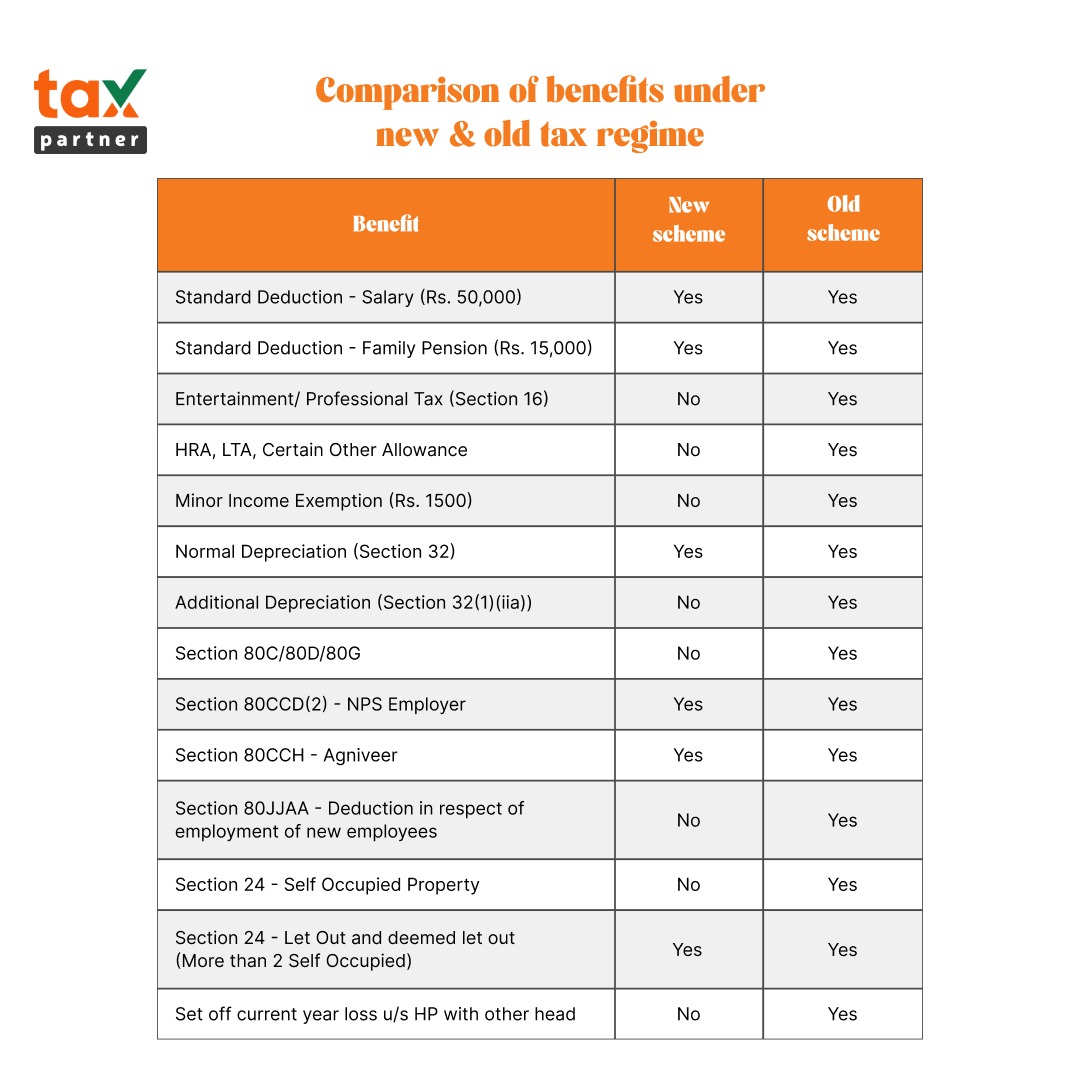

The new tax regime is characterized by concessional tax rates designed to simplify tax filing and reduce the burden on taxpayers. Key features include:

- Revised Tax Slabs: Tax rates ranging from 5% to 30% apply to different income brackets, with higher exemption limits.

- Standard Deductions: A standard deduction of ₹50,000 is available, reducing taxable income directly.

- No Exemptions and Deductions: Most traditional deductions under Section 80C (like investments in PF, PPF, life insurance premiums), HRA (House Rent Allowance), LTA (Leave Travel Allowance), and others are not applicable under this regime.

Benefits of the New Regime:

- Simplicity: Filing taxes becomes simpler as there are fewer deductions and exemptions to calculate.

- Lower Tax Rates: Concessional tax rates may result in lower tax liabilities for individuals without significant deductions.

Considerations Before Opting for the New Regime:

- Impact on Savings: Individuals accustomed to claiming deductions under the old regime for investments and expenses like housing rent and children's education may find the new regime less beneficial.

- Tax Planning: The decision heavily depends on individual financial situations and the extent of eligible deductions.

The Old Tax Regime:

The traditional tax regime continues to appeal to many due to its comprehensive range of exemptions and deductions. These include:

- Section 80C Deductions: Allows deductions for various investments and expenses up to ₹1.5 lakhs.

- HRA and LTA: Exemptions for housing rent and travel allowances, respectively.

- Benefit for Savers: Encourages savings and investments through tax benefits.

Choosing Between Regimes: The decision hinges on assessing your specific financial profile:

- Calculating Savings: Determine whether deductions under the old regime exceed the breakeven thresholds for your income level.

- Future Planning: Consider long-term financial goals and the impact of reduced exemptions in the new regime.

Expert Guidance from Taxpartner:

Understand these complexities requires expert advice and tools to maximize tax benefits and ensure compliance. Taxpartner offers comprehensive support:

- Tax Calculators: Tools to assess potential savings under both regimes.

- Expert Advice: Guidance to understand implications and make informed decisions.

- Filing Assistance: Ensuring accurate and timely tax filing under the chosen regime.

Conclusion:

As taxpayers evaluate their options between the old and new tax regimes, careful consideration of deductions, savings habits, and long-term financial goals is essential. Each regime presents unique advantages, and the decision should align with your individual tax planning strategy. With the right support and understanding, taxpayers can navigate these changes confidently, maximizing benefits while staying compliant with the latest tax regulations.

In summary, while the new tax regime offers simplicity and lower rates, the decision to switch should be driven by a thorough analysis of your financial situation. Consultation with tax experts like Taxpartner can provide invaluable assistance in making the right choice tailored to your needs.