Connect with us for all your queries

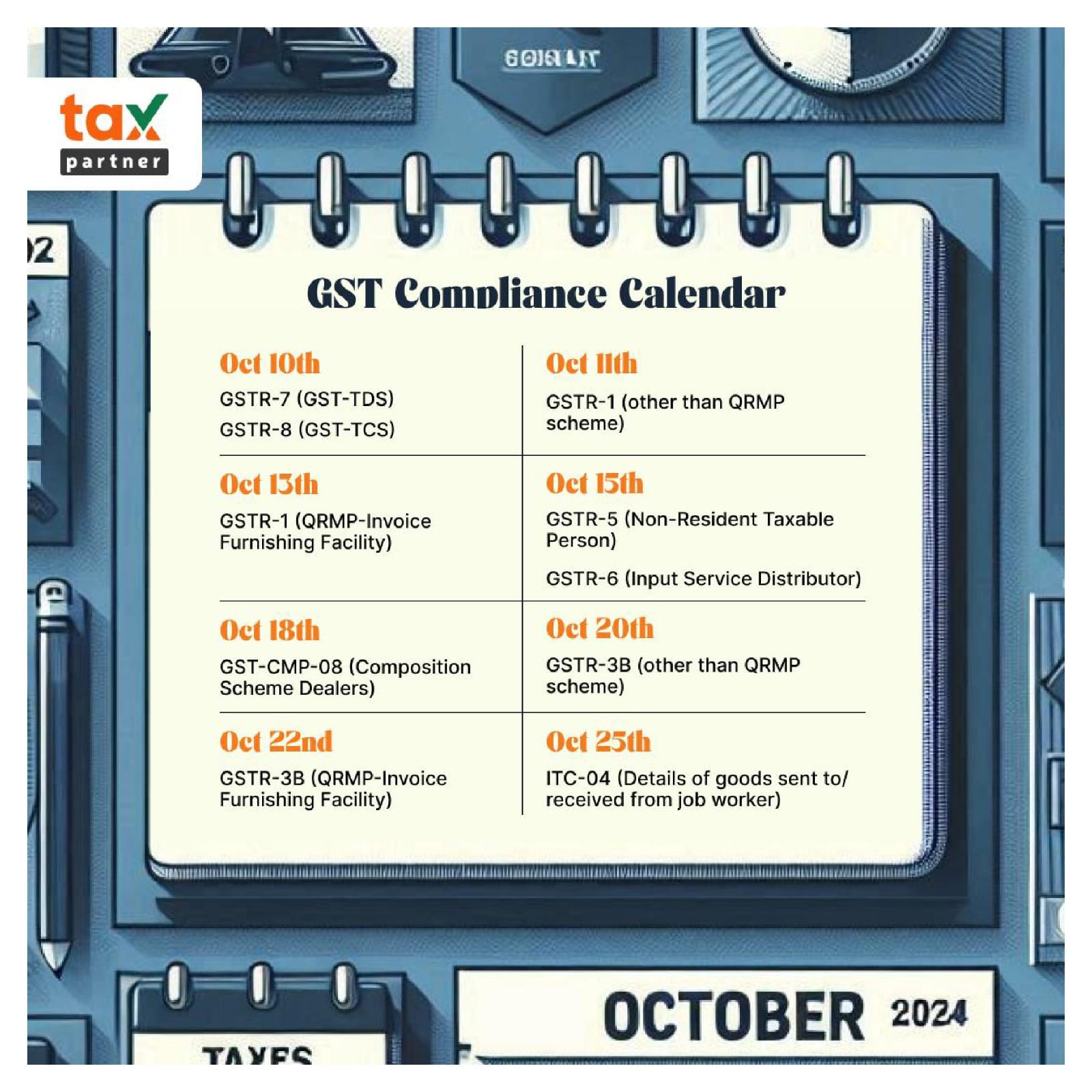

Ensure timely filing of the following GST forms:

GSTR-7 (GST-TDS):

For businesses deducting TDS under GST, this return needs to be filed to report the TDS collected and deposited.

GSTR-8 (GST-TCS):

E-commerce operators collecting TCS are required to file this form, reporting the tax collected on supplies made through their platform.

GSTR-1 (other than QRMP scheme):

A monthly or quarterly return for reporting outward supplies of goods and services for businesses not under the QRMP scheme.

GSTR-1 (QRMP-Invoice Furnishing Facility):

For businesses under the QRMP scheme, this facility allows submission of invoices for outward supplies.

GSTR-5 (Non-Resident Taxable Person):

Non-resident taxpayers are required to file this return to report the supplies they make within India.

GSTR-6 (Input Service Distributor):

For Input Service Distributors, this form is for passing on the eligible input tax credit to units or branches.

GST-CMP-08 (Composition Scheme Dealers):

This is a quarterly statement filed by taxpayers registered under the composition scheme, reporting their turnover and tax payable.

GSTR-3B (QRMP and non-QRMP):

A simplified return form for summarizing outward supplies, input tax credit claimed, and taxes paid. It's mandatory for all regular taxpayers.

ITC-04 (Details of goods sent to/received from job worker):

Businesses need to report goods sent to and received from job workers under this form, ensuring accurate tracking of stock.

Stay compliant and avoid penalties! For assistance with GST filings, reach out to The Tax Partner.

Tax Partner is India’s most reliable online business service platform, dedicated to helping you in starting, growing, & flourishing your business with our wide array of expert services at a very affordable cost.